pa educational improvement tax credit individuals

The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation. REV-1123 -- Educational Improvement.

Western Pennsylvania Montessori School

REV-1123 -- Educational Improvement.

. Retirement - Traditional IRAs and Roth IRAs. To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number. Tax Forgiveness for PA Personal Income Tax.

PSD Codes and EIT Rates. A typical Jew in Jesus time had only one name sometimes followed by the phrase son of fathers name or the individuals hometown. Taxpayer Annual Local Tax Return.

We also accept payment through. PART 3EARNED INCOME TAX CREDIT Sec. Educational Improvement Opportunity Scholarship or.

Local Income Tax Info. Jamie Connelly 724 513-1633. A Film production is eligible for the tax credit program if Pennsylvania production expenses comprise at least 60 of the Films total production expenses.

2021 KIZ Tax Credit Award Recipients Overview. Improving Lives Through Smart Tax Policy. Local Withholding Tax FAQs.

DCED Local Government Services Boards and Committees State Tax Equalization Board STEBTax Equalization Division TED Information pertaining to the STEB TED The State Tax Equalization Board STEB was initially established as an independent state administrative board by the act of June 27 1947 PL. The Ministry of Justice is a major government department at the heart of the justice system. In response to the economic effects of the COVID-19 pandemic the American Rescue Plan Act of 2021 ARPA included federal funding to reauthorize and fund the State Small Business Credit Initiative SSBCI.

ˈ æ m ə z ɒ n AM-ə-zon is an American multinational technology company which focuses on e-commerce cloud computing digital streaming and artificial intelligenceIt has been referred to as one of the most influential economic and cultural forces in the world and is one of the worlds most valuable brands. REV-775 -- Personal Income Tax Employee Business Expense Affidavit. It is one of the Big Five American information.

Application of child tax credit in possessions. Personal Income Taxes for College Students. UNCDF offers last mile finance models that unlock public and private resources especially at the domestic level to reduce poverty and support local economic development.

Act 47 Financial Distress. Recipients of a Film Production Tax Credit my use the tax credit to offset their Pennsylvania state tax liability or sell assign or transfer the credits to another entity. List of Educational Improvement Organizations Effective 712015 6302016 EITC.

Personal Income Taxes for College Students. PART 2CHILD TAX CREDIT Sec. May 16 Business applicants who have fulfilled their 2-year commitment and wish to reapply in FY 2223 to renew their 2-year commitment.

Jesus neighbors in Nazareth refer to him as the carpenter the son of Mary and brother of James and Joses and Judas and. Do not use the Single Application. An incentive program that provides tax credits to for-profit companies less than eight years old operating within specific targeted industries within the boundaries of a Keystone Innovation Zone KIZWith a total pool of up to 15 million in tax credits available to KIZ companies annually the KIZ tax credit.

Tax Forgiveness for PA Personal Income Tax. Real Estate agents or brokers can claim a deed transfer tax credit when the property was taken in trade for another property but not in excess of the tax due. The goal of SSBCI is to support small.

The Educational Tax Credits program contains two sections of which credits may be awarded for applicants within the program. Act 48 Property Tax Collectors. Our vision is to deliver a world-class.

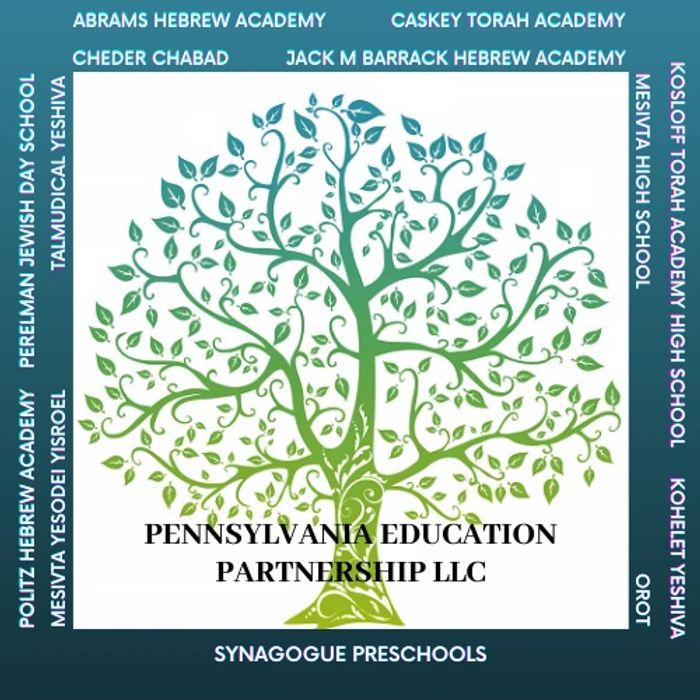

Beaver County Educational Trust. Educational Improvement Tax Credit Program EITC Opportunity Scholarship Tax Credit Program OSTC. Strengthening the earned income tax credit for individuals with no qualifying children.

Department of the Treasury. 2021 recovery rebates to individuals. Act 47 Program Page.

EU policies aim to ensure the free movement of people. Enter the amount of the specific restricted tax credit for each line expected to be received in 2022. 2005 the City and School District adopted the provisions of the Commonwealth of Pennsylvania Realty Transfer Tax 72 PS8101-C et seq.

Retirement - Traditional IRAs and Roth IRAs. We accept payment from your credit or debit cards. Taxpayer Quarterly Estimated Payments.

It is acceptable in most countries and thus making it the most effective payment method. PayPal is one of the most widely used money transfer method in the world. Child tax credit improvements for 2021.

The program is administered at the federal level by the US. The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement organizations in order to promote expanded educational. Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary.

2021 Personal Income Tax Forms. Naming convention various names. Tax credits to eligible businesses contributing to a Scholarship Organization an Educational Improvement Organization andor a Pre-Kindergarten Scholarship Organization.

REV-775 -- Personal Income Tax Employee Business Expense Affidavit. The UN Capital Development Fund makes public and private finance work for the poor in the worlds 47 least developed countries LDCs. Notable Ranking Changes in this Years Index Alabama.

Alabama policymakers eliminated the states throwback rulea complex and uncompetitive corporate income tax provision that throws nowhere income back into the sales factor of the source stateand decoupled from the Global Intangible Low-Taxed Income. Strategic Management Planning Program. Applicants interested in applying as an Educational Improvement Organization Scholarship Organization or Pre-K Organization can apply at DCED Center for Business Financing Tax Credit Division 4th Floor Commonwealth Keystone Building 400 North Street Harrisburg PA 17120.

Thus in the New Testament Jesus is commonly referred to as Jesus of Nazareth. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount. The European Union EU is a political and economic union of 27 member states that are located primarily in Europe.

REV-757 -- Employer Letter Template. An internal single market has been established through a standardised system of laws that apply in all member states in those matters and only those matters where the states have agreed to act as one. 447 known as the State Tax.

We work to protect and advance the principles of justice. REV-757 -- Employer Letter Template. Instructions for Estimating PA Personal Income Tax For Individuals Only REV-413 I IN 08-21 Payments made after December 31 2021 equal to or greater.

Latest news from around the globe including the nuclear arms race migration North Korea Brexit and more.

Do I Pay Taxes On Workers Comp Larry Pitt

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits

New Pa Budget Injects 125m Into Private School Tax Credit Program That Lacks Basic Accountability Spotlight Pa

Ifrs 9 Stages Of Risk Financial Management Risk Management Financial Accounting

Jewish Scholarship Llc Jewish Education Scholarship

Episcopal Academy The Pa Tax Credit Program

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Stl News Product Launch Improvement Projects Administration

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits

Beyond Reopening Schools How Education Can Emerge Stronger Than Before Covid 19

Critics Say State S Increased Tax Credit For Private And Parochial Scholarship Programs Lacks Accountability Cbs Pittsburgh

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Jewish Scholarship Llc Jewish Education Scholarship

Hearthsong Sky Island Swing Set Swing Set Outdoor Backyard Swing

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits